Although Qatar’s 2023 attempt to buy Manchester United failed, its ambition to one day own the historic club has not waned, according to Sam Wallace of The Telegraph.

More than a year since Sheikh Jassim bin Hamad Al Thani withdrew from the bidding process, signs suggest the Gulf state has maintained a quiet but enduring interest in the club’s future.

This interest is set against the backdrop of Qatar’s broader involvement in global football, most notably its ownership of Paris Saint-Germain through Qatar Sports Investments (QSI). Since acquiring PSG in 2011, Qatar has faced significant challenges in steering the club to European dominance, but it has also gained considerable influence in the sport. That appetite for prestige and power through football has not diminished, even as the PSG project continues to evolve.

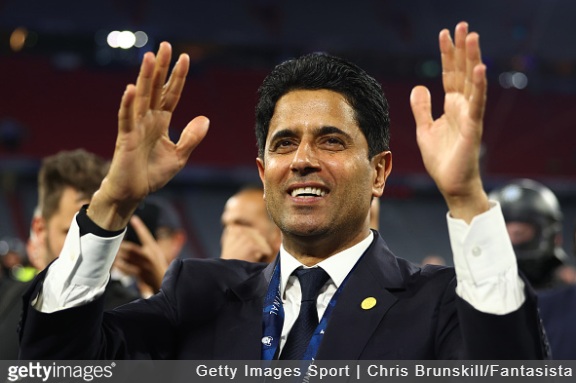

On the sidelines of this year’s Champions League final in Munich, Sir Alex Ferguson, Manchester United’s iconic former manager, was seen in the VIP section alongside PSG president Nasser Al-Khelaifi, highlighting the intertwined relationships at the highest levels of the game. Ferguson also attended a UEFA-hosted dinner alongside top club officials and dignitaries such as UEFA President Aleksander Čeferin. These social circles remain crucial arenas where major club dealings and football’s political power are often navigated, even informally.

Embed from Getty Images

Al-Khelaifi holds immense sway within European football. He chairs both QSI and the European Club Association, and also oversees the Qatari state broadcaster beIN Sports. His unique position as both a key negotiator with UEFA and a direct representative of Qatari football interests places him at the heart of the continent’s football governance. Though officially not connected to Sheikh Jassim’s Manchester United bid, Al-Khelaifi’s influence and network make him a central figure in any Qatari-backed football investment strategy.

Sheikh Jassim’s 2023 bid for Manchester United was ambitious. Channeled through his Nine Two Foundation, it proposed full acquisition of the club, including shares held by minority investors, and promised to wipe out its long-standing debt. Crucially, it offered a single upfront payment—less in total than Sir Jim Ratcliffe’s staged investment but presented in full, immediately. Despite the financial clarity of the offer, it failed to satisfy the Glazers, who ultimately opted for a more complex agreement with Ratcliffe.

The Glazers’ choice to sell a minority stake to Ratcliffe’s Ineos Group—eventually amounting to a 28.94% share—was seen as a compromise. It allowed them to retain majority control while offloading responsibility for football operations to a more hands-on investor. Since that deal, United’s financial and on-field situations have continued to deteriorate. The club’s valuation on the New York Stock Exchange has plummeted to levels reminiscent of its 2012 listing, now hovering around $14 per share. The drop in valuation mirrors the club’s poor performances: their worst league finish in 50 years, widespread staff redundancies, and mounting debt, now estimated to exceed £1 billion when accounting for transfer fees and interest.

Despite being sidelined in the 2023 bidding war, sources suggest Sheikh Jassim has not lost interest in United. There is a persistent belief within his circle that a future opportunity to purchase the club may arise. While their earlier bid faded from the public conversation, the Qatari camp continues to quietly monitor developments, waiting for a time when the Glazers may be more amenable to a full sale.

The Glazers’ agreement with Ratcliffe reportedly includes a clause that permits them to sell the club entirely—even without Ratcliffe’s consent. However, Ratcliffe holds the right to make the first offer if the Glazers choose to sell their remaining stake. This could potentially trigger a future standoff between the British billionaire and a resurgent Qatari bid.

During the initial auction process led by US bank Raine, both Ratcliffe and Jassim were seen as serious contenders. However, Jassim’s campaign was criticized for being too reserved. Only a single public photo of him was circulated, and little effort was made to present him or the Nine Two Foundation to United’s fanbase or the media. Some observers, including Ratcliffe himself, questioned whether Sheikh Jassim even truly existed, so scant were the public details available about him. Those familiar with Qatari protocol argued that their approach reflected cultural norms—opting for discretion and silence until deals are confirmed. But in this case, that reticence may have backfired.

In contrast, Ratcliffe took a far more visible role. He engaged with the media and supporters, portraying himself as a long-term fan of the club and a steward for its traditions. That visibility helped win over some segments of the fanbase and likely influenced the Glazers, who were navigating a sale with immense public scrutiny.

Still, Ratcliffe’s acquisition of just under 30% of the club has left him in a challenging position. He has taken on responsibility for United’s football direction, but he does so without full control. The club’s results have declined since his involvement, and structural problems—from high debt to underperforming managerial appointments—have persisted. The strain of turning around United while owning less than a third of the club may one day prompt Ratcliffe to seek majority control himself, possibly reigniting competitive interest from Qatar.

Embed from Getty Images

There is also a lingering sense that the Glazers, who have long resisted fully relinquishing power, will ultimately determine United’s ownership future. Their partial sale allowed them to extract capital while deflecting responsibility for football operations onto Ratcliffe. But as financial pressures mount and the club’s value stagnates, a full sale may eventually become more attractive.

The real question is whether Qatar, with its immense resources, would be willing to return with a second bid—and at what price. Even Qatar’s wealthiest families have limits, as shown by Jassim’s 2023 withdrawal, which ultimately hinged on valuation disagreements. The failure to secure a deal the first time around demonstrated that money alone may not be enough to pry the club away from the Glazers—unless market conditions shift decisively.

For now, Qatar waits. With United’s performance faltering, its value declining, and its future uncertain, the chance for a renewed takeover attempt may come sooner rather than later. As ever with Manchester United, the narrative continues to be shaped not only by what happens on the pitch, but by the complex, often opaque power plays happening far above it.